Practical Questions on Accounting Standard 2 : Valuation of Inventory

1.

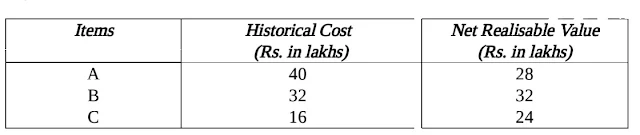

The company deals in three

products, A, B and C, which are neither similar nor interchangeable. At the

time of closing of its account for the year 2002-03. The Historical Cost and

Net Realizable Value of the items of closing stock are determined as follows:

What will

be the value of Closing Stock?

Answer:

As per para 5 of AS 2 on Valuation of Inventories, inventories should be

valued at the lower of cost and net realizable value. Inventories should be

written down to net realizable value on an item-by-item basis in the given

case.

Hence,

closing stock will be valued at Rs. 76 lakhs.

2.

X Co. Limited purchased goods at

the cost of Rs.40 lakhs in October, 2005. Till March, 2006, 75% of the stocks

were sold. The company wants to disclose closing stock at Rs.10 lakhs. The

expected sale value is Rs.11 lakhs and a commission at 10% on sale is payable

to the agent. Advise, what is the correct closing stock to be disclosed as at

31.3.2006.

Answer:

As per Para 5 of Accounting Standard 2 “Valuation of Inventories”, the inventories are to

be valued at lower of cost and net realizable value.

In this case, the cost of inventory is Rs. 10 lakhs. The net realizable

value is 11,00,000 × 90% = Rs. 9,90,000. So, the stock should be valued at Rs.

9,90,000.

3.

Items that are to be excluded in determination of

the cost of inventories as per AS2.

Answer:

Items that are to be excluded in determination of the cost of

inventories as per para 13 of AS 2 on ‘Valuation of Inventories’ are:

·

Abnormal amounts of wasted materials, labour or

other production costs.

·

Storage costs unless those costs are necessary in

the production process prior to a further

·

Administrative overheads that do

not contribute to bringing the inventories to their present location and

condition; and

·

Selling and distribution costs.

4.

Sony Pharma ordered 12,000 kg. of

certain material at Rs.80 per unit. The purchase price includes excise duty Rs.

4 per kg in respect of which full CENVAT credit is admissible. Freight incurred

amounted to Rs. 77,400. Normal transit loss is 3%. The company actually

received 11,600 kg. and consumed 10,100 kg. of material. Compute cost of

inventory under AS 2 and abnormal loss.

Answer:

Value of closing stock under AS 2 = (11,600 kgs. – 10,100 kgs.) × Rs. 85

= Rs.1, 27,500 Abnormal loss = (11,640 kgs. – 11,600 kgs.) × Rs.85 = Rs.3,400

5.

Raw materials inventory of a

company includes certain material purchased at Rs.100 per kg. The price of the

material is on decline and replacement cost of the inventory at the year end is

Rs.75 per kg. It is possible to convert the material into finished product at

conversion cost of Rs.125. Decide whether to make the product or not to make

the product, if selling price is

(i) Rs.175

and

(ii) Rs.225

*Also find out the value of inventory in each case.

Answer:

As per para 24 of Accounting Standard 2 ‘Valuation of Inventories’,

materials and other supplies held for use in the production of inventories are

not written down below cost if the finished products in which they will be

incorporated are expected to be sold at or above cost. However, when there has

been a decline in the price of materials and it is estimated that the cost of

the finished products will exceed net realizable value, the materials are written

down to net realisable value. In such circumstances, the replacement cost of

the materials may be the best available measure of their net realizable value.

i.

When selling price is Rs.175

Incremental Profit = Rs.175 – Rs.125

|

= Rs.50

|

Therefore, it is better not to make the product.

Raw material inventory would be valued at net realisable value i.e. Rs. 75

because the selling price of the finished product is less than Rs.225 (100+125)

per kg.

ii.

When selling price is Rs.225

Incremental

Profit = Rs.225 – Rs.125 = Rs.100

Current

price of the raw material = Rs.75.

Therefore,

it is better to make the product.

Raw material inventory would be valued at Rs.100 per kg because the

selling price of the finished product is not less than Rs.225.

6.

HP is a leading distributor of petrol. A detail

inventory of petrol in hand is taken when

the books are closed at the end of each month. At the end of month

following information is available:

Sales

|

Rs.

|

47,25,000

|

General

overheads cost

|

Rs.

|

1,25,000

|

Inventory

at beginning

|

1,00,000 litres @ 15 per litre

|

|

Purchases

|

June 1

two lakh litres @ 14.25

June 30

one lakh litres @ 15.15

Closing

inventory 1.30 lakh litres

Compute

the following by the FIFO as per AS 2:

i.

Value of Inventory on June, 30.

ii.

Amount of cost of goods sold for June.

iii.

Profit/Loss for the month of June.

Answer :

June

|

15,15,000

|

|||||

1,00,000 litres @ Rs.15.15

|

4,27,500

|

|||||

30,000 litres @ Rs. 14.25

|

19,42,500

|

|||||

Total

|

||||||

(ii) Calculation of cost of goods sold

|

15,00,000

|

|||||

Opening inventories (1,00,000 litres @ Rs. 15)

|

28,50,000

|

|||||

Purchases

|

June-1 (2,00,000 litres @ Rs.14.25)

|

15,15,000

|

||||

June-30

(1,00,000 litres @ Rs.15.15)

|

58,65,000

|

|||||

(19,42,500)

|

||||||

Less: Closing inventories

|

39,22,500

|

|||||

Cost of

goods sold

|

||||||

(iii) Calculation of profit

|

47,25,000

|

|||||

Sales

(Given) (A)

|

39,22,500

|

|||||

Cost of goods sold

|

1,25,000

|

|||||

Add: General overheads

|

40,47,500

|

|||||

Total cost (B)

|

6,77,500

|

|||||

Profit

(A-B)

|

||||||